At some stage, startups in Southeast Asia may want to flip (or redomicile) into Singapore, which has legal impacts. Here’s the lowdown on why you might, when you should, and what’s involved.

why should a startup think about moving to Singapore?

It depends if your startup is choosing to bootstrap or seek venture capital. If as a founder you are considering VC money, you need to be mindful of investor preferences. When investors put money into startups, they prefer a safe haven to ensure they can enforce their rights under investment documents, and get their money out easily on exit. In Southeast Asia, that generally means investing into a company from a stable jurisdiction such as Singapore.

There are other drivers of course which can be relevant when choosing jurisdiction – protection of intellectual property rights, taxation, local-foreign ownership and capital requirements. Again, Singapore ticks most of the boxes.

when should a startup move to Singapore?

The easiest way to avoid the company secretarial and legal costs associated with flipping is to not flip at all – i.e. by incorporating your holding company from the outset in the most investment friendly place. That’s not always possible of course for various reasons.

If you do decide to redomicile your startup, then the earlier you act the better. Otherwise, the potential restructuring can be harder. For instance, intellectual property rights and key financing, commercial and employment agreements may need to be assigned to the new holding company.

Startups are often pressured to flip at the same time as a proposed capital raise, typically at the request of investors. Founders should exercise caution here. Terms sheets are non-binding and promises of investment based on the company flipping may not materialise into an actual investment.

how do you flip or redomicile a startup to Singapore?

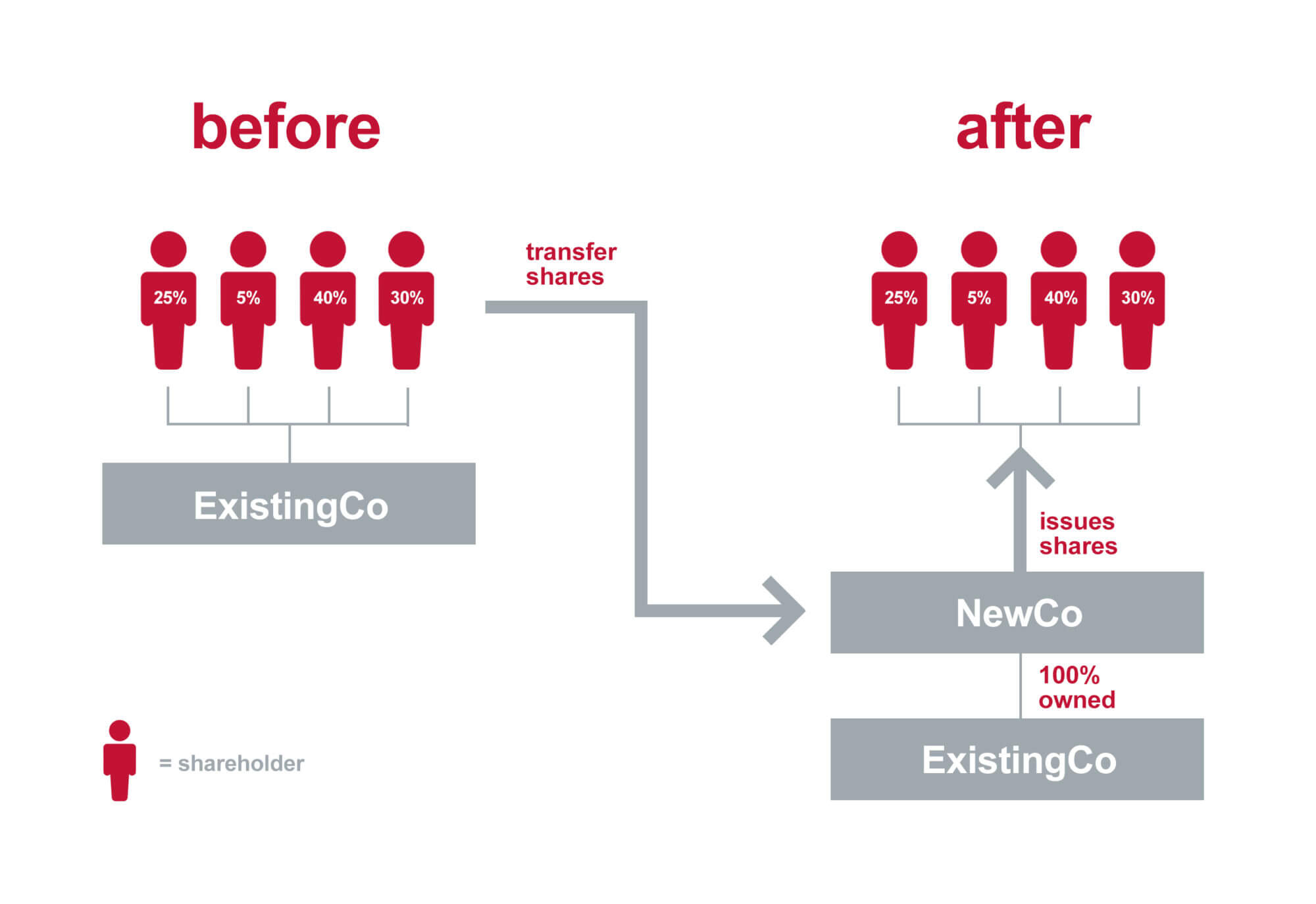

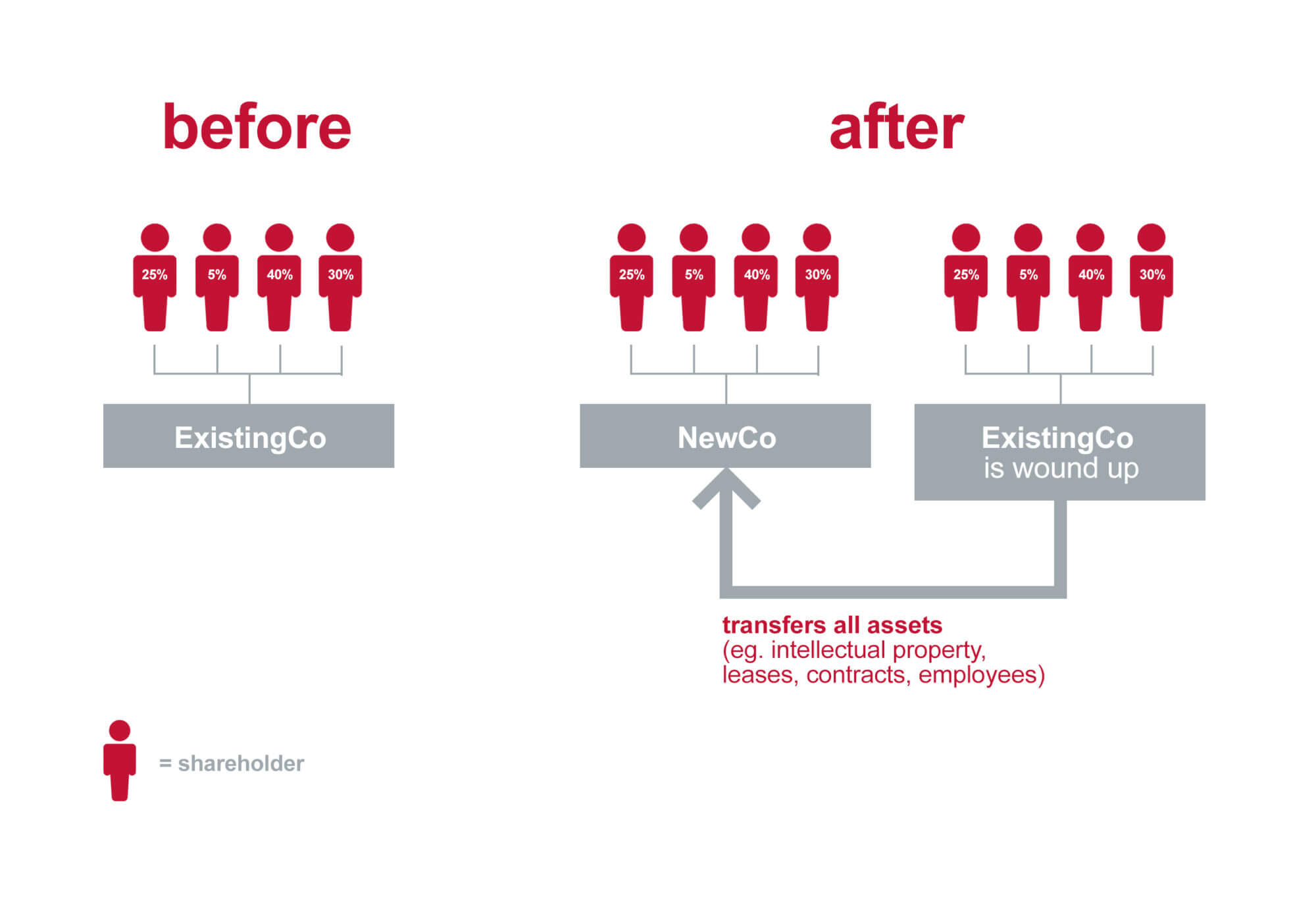

Flipping to a new jurisdiction can be done by either a transfer of shares (see diagram 1) or a transfer of assets (see diagram 2).

option 1: share transfer (most popular approach)

A share transfer is the simplest and most common approach. It works like this:

- you set up a new holding company in Singapore (NewCo)

- the Existing Company (ExistingCo) transfers all of the shares in ExistingCo to NewCo.

- NewCo then immediately issues shares in NewCo to mirror the holdings that had been held in ExistingCo.

Here are a few things you will need to consider if you flip via a share transfer:

- these are separate corporate transactions in two different jurisdictions. As a result, it’s a good idea to get legal and tax advice on both. For example, the share transfer may be a liquidity event in certain jurisdictions triggering a tax charge on the deemed capital gain.

- you need to attribute a value to the ExistingCo shares being transferred for the purposes of recording the share issue. This may mean you need to consider your company’s current valuation at the time of the transaction.

- although shares are being issued, no money is paid for the shares. You will need an agreement setting out the terms of this non-cash consideration. Our share exchange agreement is a useful template to record this kind of transaction. If you choose to use our share exchange agreement, you’ll need to have the agreement reviewed with local lawyers for compliance.

Overall, this is a fairly straightforward process on the Singapore side and can be done fairly efficiently with a lawyer and a corporate secretary working together, but can differ in cost and speed depending on the lawyers that you use in your home country.

option 2: asset transfer

Flipping your company by way of an asset transfer is usually more complex because it requires the sale of individual assets from ExistingCo to NewCo. Given this, an asset transfer is only used if there are legal, tax or commercial issues with a share transfer.

An asset transfer involves assigning or transferring intellectual property, key assets, contracts and employees. These assignments and transfers may require the consent of third parties.

This process usually leaves ExistingCo without any assets other than either shares in NewCo or a debt from NewCo (the consideration or amount ‘paid’ for the asset transfer).

issues to watch out for when flipping your company into Singapore

- you will need to carry out some due diligence on your own company before flipping it. Aside from local legal and taxation matters, check whether existing contracts and other arrangements will be impacted by the redomicile, e.g. a shareholders’ agreement will need to be mirrored and restated under the laws of NewCo’s jurisdiction.

- the transfer of shares needs to be executed in the same way as any other share transfer, i.e with the usual stamping, approvals and registrations that are required under the applicable law. However, as no cash passes, you need to check how the transfer needs to be recorded for accounting and tax purposes.

- check any existing contracts you have. The share transfer may constitute a change of control or liquidity event under existing commercial contracts, financing documents or leases. You should review existing documents and get consent from third parties, if required.

- convertible notes issued to investors will need to be reissued by, or assigned to, the NewCo, as will any founder vesting agreements in place.

- any share option plan will need to be cancelled, restated at NewCo level, and adapted for local law and standards.

If you’d like to get more information about what’s involved with a company redomicile, speak to us.